By Alan M. Rugman

This publication bargains a clean standpoint at the function of firm corporations (MNEs) in improvement. Alan M. Rugman and Jonathan P. Doh problem conventional assumptions approximately fiscal improvement and handle the controversies that encompass MNEs. for instance, how do international multinationals have an effect on total fiscal progress in rising economies, and the way does this procedure bring about the next upward thrust of latest emerging-economy MNEs? The authors specialise in the mechanisms in which MNEs impression financial improvement. They evaluation the impression of MNEs at the procedures and results of improvement, in addition to the effect of civil society, NGOs, and govt regulations on multinationals, in particular in Asia. they usually talk about the increase of emerging-economy MNEs from Asian economies, specially “yang” MNEs from China and Korea. Arriving at a much more nuanced knowing of MNEs this present day, the authors additionally supply observations in regards to the function of multinationals sooner or later.

Read or Download Multinationals and Development PDF

Similar business development books

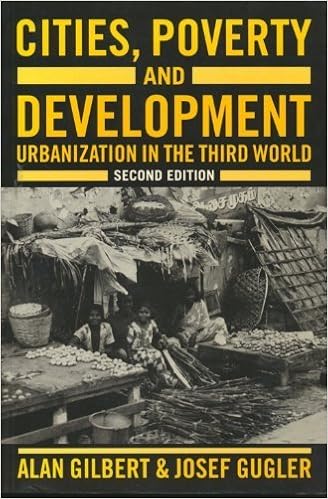

Cities, Poverty and Development: Urbanization in the Third World

This research provides a finished account of 3rd international urbanization. It discusses the evolution of 3rd international citie, the character of city and local disparities inside of nations, the explanations and styles of rural-urban migration, the constitution of city labour markets and the inability of efficient employment, the city housing industry and well known responses to it, city methods of lifestyles and the adaption of migrants, a number of styles of political clash, and present matters in city and local making plans.

Recognising Non-Formal and Informal Learning: Outcomes, Policies and Practices

Even though studying usually occurs inside of formal settings and targeted environments, loads of precious studying additionally happens both intentionally or informally in daily life. coverage makers in OECD international locations became more and more acutely aware that non-formal and casual studying represents a wealthy resource of human capital.

Conquering Global Markets: Secrets from the world’s most successful multinationals

Conquering international Markets deals exams of the problems, statistics, instances, and most sensible practices of mergers, acquisitions, joint ventures and alliances during the global. utilizing info gleaned interviews with CEOs, the e-book presents insights into making worldwide M&As profitable.

Becoming Hewlett Packard: why strategic leadership matters

Invoice Hewlett and Dave Packard invented the version of the Silicon Valley start-up and set in movement a technique of company turning into that made it attainable for HP to remodel itself six occasions over the seventy seven years considering its founding within the face of sweeping technological alterations that felled so much of its opponents through the years.

- Business Networks in East Asian Capitalisms: Enduring Trends, Emerging Patterns

- Spatial Inequality and Development (UNU/WIDER Studies in Development Economics)

- Promoting Economic Cooperation in South Asia: Beyond SAFTA

- The Little Green Data Book 2011 (World Development Indicators)

- Regulating International Business

- Markets for Water: Potential and Performance (Natural Resource Management and Policy)

Extra info for Multinationals and Development

Example text

We know of no example of a type D network-type subsidiary in any developing country, at least in terms of the organizational structure of the 500 43 44 Multinational Strategies and Development largest MNEs in the world, over 85 percent of which are triad based. These MNEs tend to develop type D networks across the triad, but not in developing countries. A similar problem exists for type E enterprises. Other than a few state-owned businesses, especially in the petroleum and mineral-resource sectors, only a score of large MNEs come from developing countries.

There is a strategic asymmetry in the short term that a national responsiveness policy by small open economies can minimize. In the long term, Multinational Strategies and Development shelter obviously works against the triad firms that build their economic performance on it. Thus it is always advisable for firms in small open economies to follow efficiency-based strategies, in both the short and the long term; however, these strategies should be paired with government policies designed to reduce or eliminate trade protections.

We have calculated the outward FDI stocks of Australia, Japan, New Zealand, and the Republic of Korea with respect to the twelve Asia-Pacific countries, and the intraregional stock of outward FDI in the Asia-Pacific region also rose over the fifteen-year period to over 20 percent in 2003. One might argue that the growing economic power of the Asia-Pacific region would attract FDI stocks not only from countries inside the region but also from the rest of the world. 7 we compare outward FDI stocks in the Asia-Pacific region for the three regional triad blocs.